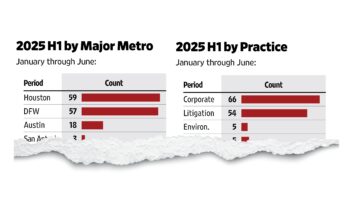

CDT Roundup: 11 Deals, 8 Firms, 99 Lawyers, $2.5B

Texas M&A staged a comeback year in 2021 with some astonishing deal numbers. But behind those numbers lies some interesting changes in the business sectors that both gained and changed. Some are obvious, like healthcare and infrastructure; but some are not so obvious, like food. The CDT Roundup looks at some of those numbers and, in particular, one food deal that typifies several ways in which the food sector is changing, along with last week's dealmaking and the firms involved.