Two big transactions involving Texas lawyers helped move the value needle last week, despite shaky-looking deals in the rest of the M&A world thanks to the coronavirus.

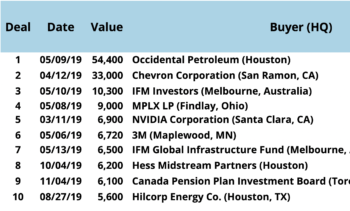

Corp. Deal Tracker 2019 M&A Master List – 303 Texas Transactions and the Lawyers who Led Them

If a Texas lawyer works on an M&A transaction, The Texas Lawbook’s exclusive Corporate Deal Tracker database documents it. Today, The Lawbook has published our master list of all non-confidential transactions from 2019. The Corporate Deal Tracker lists the lawyers and law firms who represented the buyers and sellers in all 303 transactions.

Corporate Deal Tracker Chart: 2019 M&A

If a Texas lawyer worked on a corporate transaction – even if the deal involves non-Texas clients – The Texas Lawbook documents it as part of its Corporate Deal Tracker. Today, the CDT publishes its master list of non-confidential mergers and acquisitions for 2019. The M&A non-confidential database features 303 transactions and the lawyers who worked on them.

CDT Roundup: 7 Deals, 7 Firms, 36 Lawyers, $809.8M

Dealmaking among Texas lawyers was way down this past week, thanks to the spreading coronavirus and sliding oil prices. But transactions were already sickly even before the recent COVID-19 fears. Claire Poole explains.

Akin Gump Dallas Attracts Transaction Pair from Haynes and Boone

Ryan Cox was co-head of Haynes and Boone’s capital markets and securities practice while Eric Williams was chief of its M&A practice.

Energy M&A Experts: ‘A Long Dark Tunnel’

As the markets tumbled this week, The Lawbook’s Claire Poole began polling M&A experts for their take on what the future might hold. Their view was stark for the short term, cautious in the long term and instructive on the lessons that might be learned.

CDT Roundup: 16 Deals, 15 Firms, 70 Lawyers, $2.5B

It was a semi-busy deal week last week for Texas lawyers. But Monday’s stock market collapse – the biggest since the 2008 financial crisis – could be a transaction killer until a clear recovery is underway.

‘A Jarring Wakeup Call’

Pickering Energy Partners’ Dan Pickering offers his views of the turmoil in the oil and gas markets and what it means for dealmaking and bankruptcies in the sector.

‘No Place to Hide for Energy’

Oil prices and energy stocks are plunging, thanks to the coronavirus and Russia refusing to cut production, leading to worries about M&A and new bankruptcies. Observers are calling on companies to work toward generating more free cash flow by lowering spending and cutting production so they can pay down debt – and maybe acquire wounded competitors.

Tasha Schwikert: From Olympic Athlete to Mergers & Advocacy

She was a bronze medalist in the 2000 Olympics, but Tasha Schwikert’s role as an ex-athlete and lawyer may yet prove her most enduring. As Natalie Posgate explains, the reasons are personal.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 74

- Go to page 75

- Go to page 76

- Go to page 77

- Go to page 78

- Interim pages omitted …

- Go to page 113

- Go to Next Page »