As they were closing their books on 2022, corporate law firms operating in Texas told The Texas Lawbook they expected another good year once all the numbers were collected, crunched and finalized.

Today, we start documenting how good.

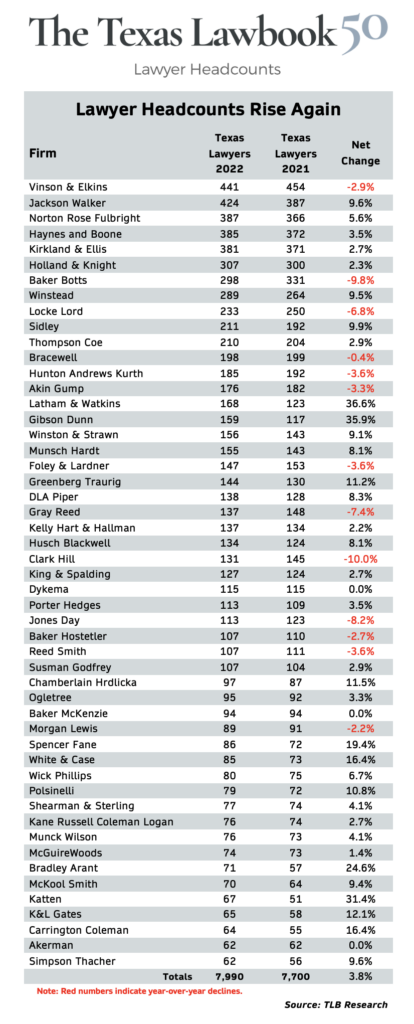

The new Lawbook 50 headcount rankings – now in its eighth year – show the leading firms in Texas corporate law employed 7,990 lawyers at the end of 2022, a net gain of 290, or 3.8 percent, over the previous 12 months. (This year’s ranking contains 51 firms since two firms tied for No. 50.)

The 2022 gain nearly matched the increase the Lawbook 50 saw the previous year, when employment increased by a record 301 lawyers – a 4.1 percent hike. 2021 was the best year ever for hiring corporate lawyers, according to data going back to 2010 and the memories of industry veterans who have been around for decades.

In addition to more lawyers, the 2022 survey shows that more than 70 percent of firms increased employment. Just a half dozen lost more than six lawyers. Texas-based firms dominated the Top 10 – but didn’t add many lawyers. National firms employed a larger share of Texas corporate lawyers. Only a handful of new firms made the rankings.

“We’ve had significant growth the past year or two – a lot of our hiring was client and demand specific,” said David Dawson, chair of Winstead, eighth in the new Lawbook 50 after a net gain of 25 lawyers – all added through lateral hiring. “We have been laser focused in the areas our clients need us – real estate, finance, public-private partnerships, airlines and aircraft. That discipline is the reason we’ve been successful in growing.”

V&E Remains No. 1

Chart 1

Vinson & Elkins remains on top with 441 lawyers, down 13 from 454 in 2021 (chart 1). V&E has held the top spot in the Lawbook 50 headcount rankings since 2017, when it first nosed out Norton Rose Fulbright.

Holding on to second place, Jackson Walker narrowed the gap with V&E by adding 37 lawyers to finish the year at 424.

“We hire lawyers at this firm with an emphasis on growth,” said Wade Cooper, Jackson Walker’s managing partner. “It’s a credit to what we’re doing here that we’ve been able to attract so many good people.”

Norton Rose Fulbright added 21 lawyers to move up two spots in 2022, jumping over Haynes & Boone, up 13, and Kirkland & Ellis, up 10.

“Our growth was absolutely intentional,” said Jeff Cody, Norton Rose Fulbright’s U.S. managing partner. “We have a five-year roadmap, and a key part is growing the firm’s headcount. In Houston, the growth was in our energy practice. But the growth was across the board.”

Kirkland comes in fifth place with 381 lawyers, posting a modest net gain of 10 lawyers in 2022. In the previous four years, Kirkland shot up the rankings by adding 226 lawyers, more than any other firm in Texas corporate law. It led the Lawbook 50 by adding 51 lawyers in 2021.

Latham, Gibson, Katten : Phenomenal Growth

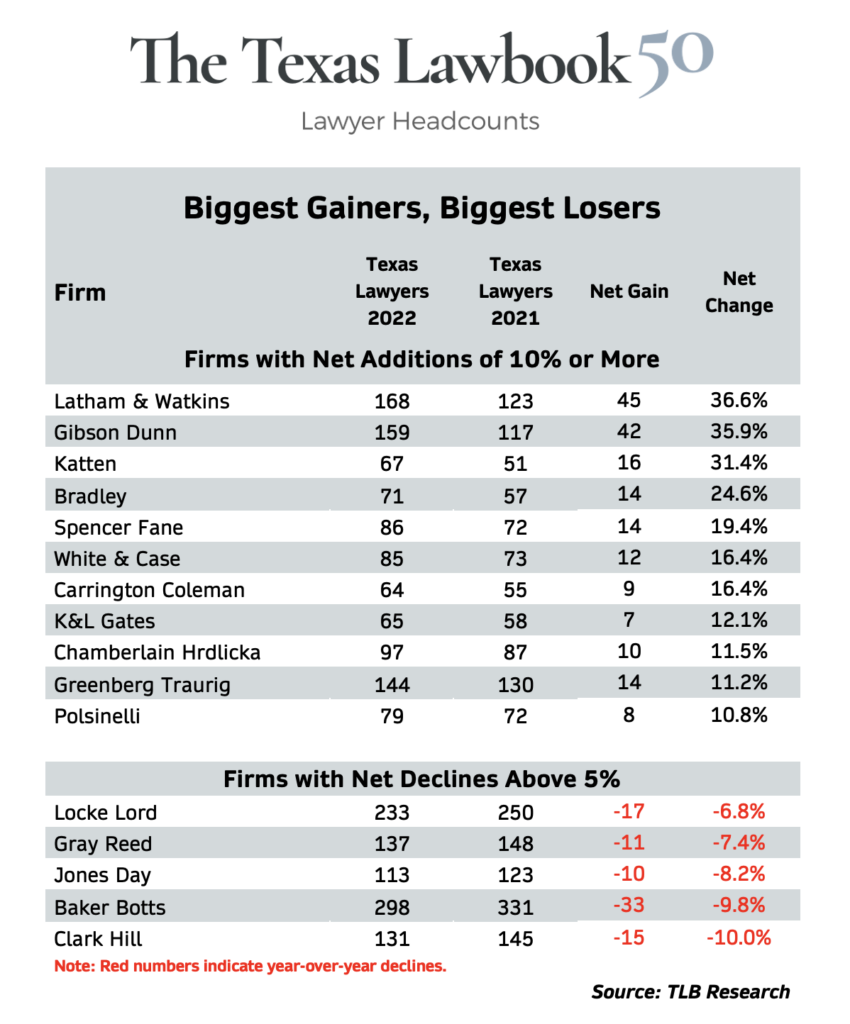

Two firms stood out with large numerical net gains in Texas lawyer headcounts – Latham & Watkins with 45, a 36.6 percent gain, and Gibson Dunn at 42, up 35.9 percent. Adding 16 lawyers, Katten grew its headcount by 31.4 percent, and Bradley was up 14 for a 24.6 percent increase. Seven other firms increased their lawyer corps by 10 percent to 20 percent (chart 2).

Baker Botts saw a decline of 33 lawyers – a 9.8 percent drop – losing 18 more lawyers than any other firm.

“We didn’t over hire in recent years as many law firms did,” Baker Botts managing partner John Martin said. “We were not saddled with too many lawyers. Plus, we had some retirements. Attrition is part of Big Law.”

Chart 2

Twelve other firms saw net lawyer headcounts decline in 2022, with only Clark Hill down 10 percent. Including V&E and Baker Botts, six firms saw double-digit numerical declines in 2022, up from just two in 2021.

The whales continued to dominate the Lawbook 50. The 10 largest firms employed an average of 336 lawyers in 2022 – taken together, more than 42 percent of the total. The 10 smallest firms averaged just 69 attorneys, with a combined share of less than 9 percent.

The Lawbook 50’s top half had almost 73 percent of the lawyers; the bottom half, 27 percent. Six of the Top 10 posted double-digit headcount gains, but double-digit declines at V&E, Baker Botts and Locke Lord took a toll on the group. The 10 largest firms added 69 lawyers in 2022, just six more than the 10 smallest firms.

Chart 3

Other Headcount Tidbits

- Texas-based firms continued to dominate the rankings’ higher echelon, taking seven of the Top 10 spots. Kirkland and Norton Rose Fulbright were both repeaters from 2021. Sidley added 19 lawyers to jump from 12th in 2021 to 10th in 2022, elbowing out Texas-born Bracewell, now No. 12.

- The Lawbook 50’s 20 Texas-based firms were bigger, with an average of 188 lawyers per firm. The 30 national firms had an average of 136 lawyers.

- The net gain of 290 lawyers skewed toward the national firms, most of which set up shop in Texas during the past decade. Their collective headcount increased by 232 lawyers, an increase of 5.8 percent. The Texas firms’ net gain was just 57, or 1.5 percent.

- The national firms have been hiring lawyers away from Texas firms for years. They grew their share of the Lawbook 50 headcount from 51.8 percent in 2021 to 52.9 percent in 2022.

- Some new names appear in the 2022 rankings: most notably, Thompson Coe, a home-grown Texas firm with 210 lawyers, good enough to claim the 11th spot. Other newcomers are Spencer Fane, Wick Phillips and Bradley. The firms hadn’t submitted data in previous years.

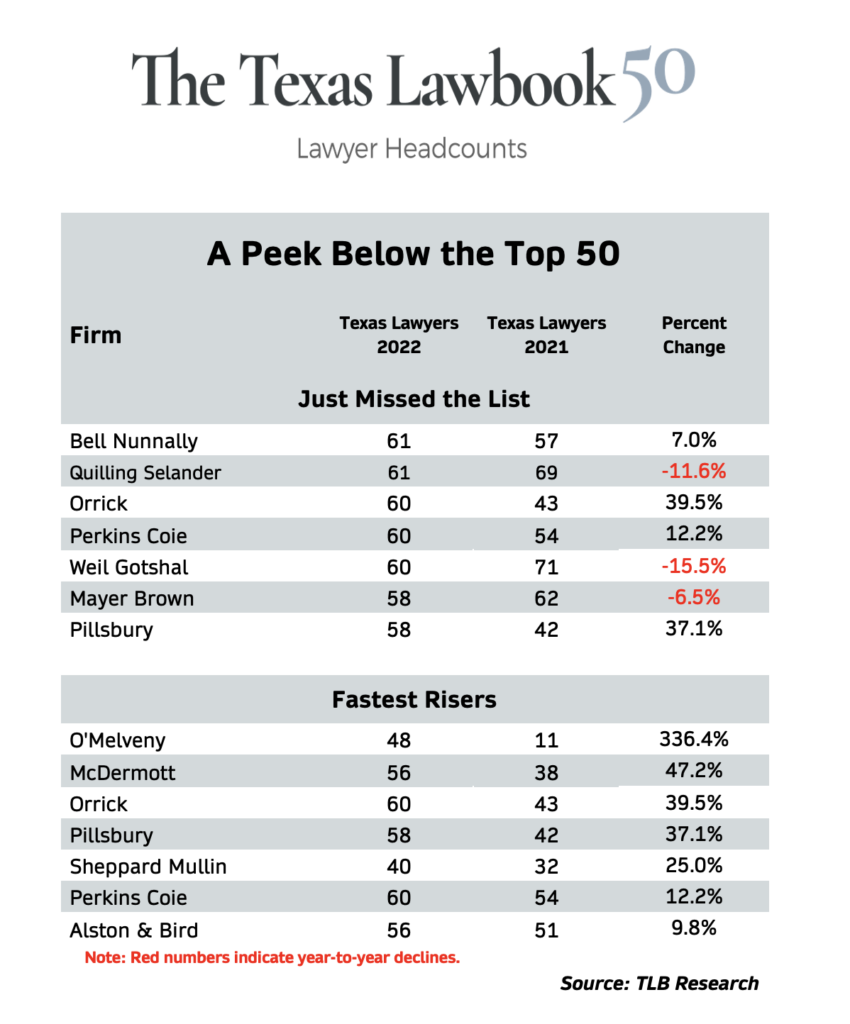

- Three firms from last year’s Lawbook 50 just missed the cut in 2021: Bell Nunnally, Weil Gotshal and Mayer Brown (chart 3, top).

- Los Angeles-founded O’Melveny, which entered the Texas market by opening a Dallas office in 2021, heads a group of fast risers that might make their way onto a future Lawbook 50 headcount (chart 3, bottom). We’ll keep an eye on them.

What’s Ahead in 2023?

Texas corporate law was as busy as ever in 2022, and firms went into this year with plenty of work to do. Greg Bopp, managing partner at Bracewell, told The Lawbook that his firm has been busy across the board – energy infrastructure, litigation, regulatory issues, public finance and government relations.

Bopp and others say they’ve continued hiring in the first three months of the year and more new faces might come on board later in the year, if the demand is there.

“We’ll probably have an active lateral presence in 2023, he said. “We are talking to a lot of potential candidates in Texas.”

At Hunton Andrews Kurth, which saw lawyer headcount slip from 192 to 185, Sam Danon, who took over this month as managing partner, had a similar sentiment: “We will continue to address our needs in 2023. We will continue to be opportunistic in the way we look at our lateral hires.”

Some key data points indicate healthy net gains in lawyer headcounts are likely this year. Vinson & Elkins, the state’s largest corporate law firm, has 163 law students in its summer associate program this year – up from 141 last year and 119 in 2021. In its first few years in Texas, Kirkland didn’t bring summer associates to Texas, but it will add as many as 70 first-year attorneys in September, the firm’s largest rookie class since opening in Houston in 2014.

Firm leaders are typically optimistic in Texas – and usually it’s justified. Other voices, however, are more cautious on the outlook for hiring in 2023.

Michael McKenney, managing director of Citi Private Bank’s Law Firm Group, says his national surveys suggest firms expect to be cautious about hiring because of worries about stresses in the overall economy – interest rates and a possible recession. “It’s hard to see demand broadly improving” before 2024, he said.

Legal recruiter Randy Block, owner of Performance Legal Placement in Dallas, told The Lawbook he was busier than ever in 2022, placing 40 lawyers, up from 31 the previous year and 19 in pandemic-plagued 2020.

Block remained busy early in 2023 – lately, though, he’s noticed a chill in the market for lawyers. “Firms are not hiring now due to being at associate capacity while fearing a downturn in legal work,” Block said.

What did all those added lawyers mean for firm finances in 2022? The Lawbook 50 headcount survey’s strong results suggest the corporate law business kept on humming in Texas last year. In a few weeks, The Lawbook will examine the financial side more directly, with its annual review of total firms’ Texas revenues, profits per partner and revenues per lawyer.

Tomorrow, The Lawbook examines past headcount data and finds an interesting change that occurred in 2019 but was obscured by the Covid-19 pandemic.

The Texas Lawbook 50

April 6 – Susman Godfrey Turns 40, ‘Best Year Ever’

April 10 – The Big Three: Baker Botts, Fulbright and V&E: Different Journeys, Different Results, Still Big