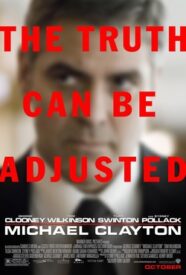

Is Michael Clayton a lawyer movie? It’s a fair question, given that the main character isn’t really a lawyer. He operates in the dark corners of the legal profession, trying not to get too dirty, until he reaches a point where he can no longer look at himself in the mirror. Played by George Clooney, Michael Clayton isn’t the kind of movie to supply an unequivocal happy ending. Having settled accounts, Michael climbs into the back of a New York City cab, hands the driver some money and tells him to drive — anywhere. The credits roll over Clooney’s pensive face.

More Stories

Lawyers, Guns and Money: An Occasional Series on Movies, TV and Other Stories About Lawyers and the Law

Energy Transfer Scoops Up Crestwood for $7.1B in Stock

Kirkland counseled the buyer and V&E the seller in a combination that analysts say makes strategic sense.

With Police Actions Recently Targeting Journalists, Will Courts Protect the Rights of the Free Press?

Last Friday, police in Marion, Kansas, seized the computers, file servers and personal cellphones of journalists at the local newspaper, the Marion County Record. According to a search warrant, officers believed there was probable cause that newspaper personnel had used equipment seized by officers to commit identity theft. Journalism is not a crime. Reporters and editors are not criminals. The First Amendment guarantees it. This common view of freedom of the press in America appears to have escaped the attention lately of at least one police department in Kansas. And one in Texas, too.

Dallas Judge Who Appointed Campaign Treasurer as Receiver Won’t Be Recused

The defendants in a breach of contract dispute had argued that Dallas County District Court Judge Ashley Wysocki’s appointment of her campaign treasurer, James Stanton, as receiver in the case mandated her recusal. Judge Wysocki and Regional Presiding Judge Ray Wheless disagreed.

Updated — Appeals Court Upholds Suspension of Dallas Lawyer David Finn Over Alcohol-Fueled Misconduct

An eight-page opinion by a Fifth Circuit panel cites “several instances of inappropriate behavior” by Finn, a former state district judge, including “twice failing to show up for a client’s sentencing hearing.”

Hey Claude, Evaluate This!

Last fall, ChatGPT took the world by storm, allowing millions to experiment with “generative artificial intelligence” through a simple and intuitive interface. ChatGPT’s success drew competitors, one of which is Claude, whose creators claim it can analyze long PDF documents. To see what Claude could do, I uploaded the petitioners’ and respondents’ briefs from Dobbs v. Jackson Women’s Health, the 2022 case that overruled Roe v. Wade.

CDT Roundup: 19 Deals, 13 Firms, 184 Lawyers, $9.7B

Of course, having noted the continued primacy of the energy industry in Texas dealmaking of late, we hit a week when there are none. Moreover, capital markets came roaring back last week with a dozen deals reported, the most reported for a single week in more than two years. Claire Poole takes a closer look at those deals and the lawyers behind them this week in the CDT Roundup.

Weil Poaches Energy Deal Lawyer from Skadden

Cody Carper, who focuses on complex energy and infrastructure transactions, has counseled Macpherson Energy, North Hudson Resources, Samson Energy, Contango Oil & Gas and Southwestern Energy on deals.

Litigation Roundup: A $1.2B ‘Revenge Porn’ Verdict, Texas’ Vision Care Law Draws Suit

In this edition of Litigation Roundup, a Houston jury awards a woman $1.2B in a revenge porn case she brought against her ex-boyfriend, the state of Texas is facing another lawsuit over a new law set to go into effect Sept. 1, and McCathern teams up with civil rights lawyer Ben Crump in a suit against Harris County over its treatment of jailed individuals.

Who is Paying Allen Stanford’s $500 Appellate Filing Fees?

Lawyers for the court-appointed receiver in the R. Allen Stanford Ponzi scheme case have asked a federal judge to order Trustmark National Bank to fork over the $100 million it agreed to pay earlier this year in its settlement with victims of the fraud.

Trustmark, according to documents, has declined to pay the receiver the $100 million because Stanford, who is in federal prison serving a 110-year sentence, has objected to the settlement agreement claiming that his conviction was unconstitutional and that the receivership should be dissolved on subject matter jurisdictional issues.