Andy Smetana took what he considers an unconventional path to transactional law. After graduating from Boston University School of Law, he sensed that the conditions weren’t favorable for dealmaking. He patiently worked as a litigator while waiting for corporate and market opportunities to improve. Once they did, Smetana quickly transitioned into the transactional sector and has not looked back since, he told The Texas Lawbook.

M&A Newsmaker: Michael King and His Crowning Achievements at Latham

Drawn by Latham & Watkins’ dominance in oil and gas transactions and its legal reputation he described as akin to playing for the New York Yankees, Michael King joined its Houston office as a partner in 2012. Over 13 years at Latham, King has been involved in a number of notable energy deals and more. He recently discussed his path to becoming a lawyer, his deep experience in the O&G sector and his expectations for the rest of the year with The Texas Lawbook.

CDT Roundup: Deadline for Submitting Deals for M&A Rankings is Next Week

In this edition of CDT Roundup for the week ending March 29, there were 21 Texas-related transactions valued at a total $8.2 billion. The week prior had seen 19 deals for $6.5 billion. It was the third straight week of volume uptick since the 2025 low of seven deals for $2.2 billion for the week that ended March 8. This time last year, there were 12 deals for $9.3 billion. Also, The Texas Lawbook has new 2025 quarterly deadlines for deal submissions to qualify for its quarterly and annual firm and lawyer deal rankings. Firms and lawyers who wish to be considered for the first quarter and year-end Lawbook leaderboards for M&A and CapM must submit all of their first-quarter deals by April 7 at 5 p.m.

Texas Transaction Trailblazers: Michael Piazza Led in Deals, Shamus Crosby in Dollars

Driven by a mix of private equity interest, family office investments and strategic consolidations across multiple sectors, dealmaking was strong in 2024, particularly in Texas, revealing resilience even as the year closed amid tightening credit and unexpected headwinds. Two lawyers stood out in that Texas M&A landscape, each making their mark in distinct ways: Gibson Dunn’s Michael Piazza and Simpson Thacher’s Shamus Crosby.

M&A Newsmaker: Katten’s David Washburn and the Anatomy of a Deal

David Washburn always felt “hardwired” to become a lawyer despite his father and others trying to sway him down different paths while growing up. “In what I now understand to be my dad’s attempt to induce me to take another path, he gave me a copy of Gray’s Anatomy when I started high school. The book bored me to tears,” he said, noting it as a moment that further pushed him to pursue law.

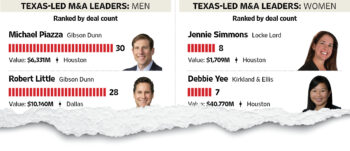

CDT Exclusive Data: 2024 Top M&A Dealmakers in Texas

There are some new leaders atop the 2024 M&A scoreboard. Most of the regulars are there, as well as some fresh faces, according to The Texas Lawbook’s exclusive Corporate Deal Tracker. The CDT has two separate rankings for Texas-led transactions — deal count and deal value. Lawyers on both lists had an extraordinary 2024.

M&A Newsmaker: Sidley’s Sara Garcia Duran Closes Deals and Opens Doors

Sara Garcia Duran never considered becoming a lawyer until she was asked to make a decision while on a student trip in high school. She thought about being a politician, but that option didn’t sound terribly appealing. “I’ll go join the lawyers,” Duran said.

The M&A-focused partner at Sidley is pleased with her choice. Duran recently gave The Texas Lawbook an in-depth look into her journey and her experience as a woman working as a Texas dealmaker.

Exclusive CDT Data — Kirkland, Gibson, V&E, Haynes Boone and Latham Top 2024 Texas-Led M&A Rankings

Mergers and acquisitions practices at nearly all law firms operating in Texas thrived in 2024. Eight law firms in Texas saw their M&A lawyers lead buyers, sellers and targets in 50 percent more M&A deals last year than they did in 2023, according to exclusive new data from The Texas Lawbook’s Corporate Deal Tracker. Nine other law firms witnessed a 10 percent or more increase in leading the principals in M&A activity in 2024, CDT data shows. But no law firm’s Texas deal lawyers were busier in 2024 than those at Kirkland & Ellis.

DOJ Sues to Block HPE’s $14B Acquisition of Juniper Networks

The U.S. Department of Justice filed suit in Northern California Thursday seeking to block the $14 billion acquisition of Juniper Networks by Texas-based Hewlett Packard Enterprise Company. Although investigated and recommended during the Biden Administration, the lawsuit is the first major regulatory litigation by the incoming Trump Administration.

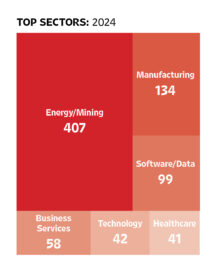

M&A in 2024: A Big Bite for Small Deals

The roster of M&A deals in 2024 suggests that we should be thankful for small things. Or, at least, small deals, according to the Corporate Deal Tracker.

- « Go to Previous Page

- Go to page 1

- Go to page 2

- Go to page 3

- Go to page 4

- Interim pages omitted …

- Go to page 47

- Go to Next Page »