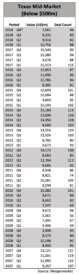

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for

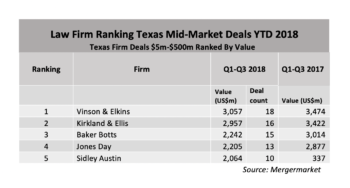

Mid-Market YTD 2018: Law Firm Deal Value Rankings

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession.

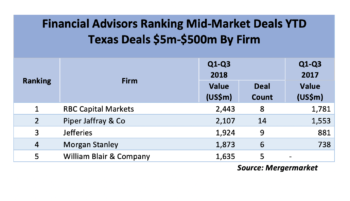

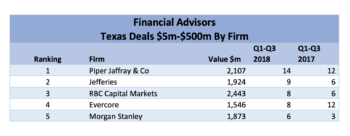

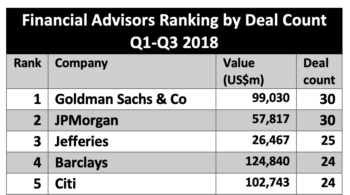

Mid-Market YTD 2018: Financial Advisors

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession. Here’s how financial advisors are stacking up through Q3.

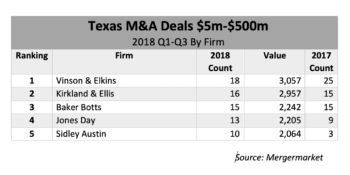

Mid-Market YTD 2018: Law Firms

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession. Click here for an expanded chart of how law firms stack up by deal count in the mid-market so far this year.

Does An Unexpected Mid-Market Low Mean Trouble For M&A? Maybe. Maybe Not.

Fourth quarter mergers and acquisitions involving middle and lower middle market Texas businesses have hit an unexpected low. Texas lawyers say their businesses are currently thriving, but the drop shouldn’t necessarily be ignored. Claire Poole and Mark Curriden have their insights on a perplexing end for 2018.

Skyview Capital’s Darryl Smith: Looking to Tap Texas Market for Carve-outs

Skyview is a Los Angeles-based private equity firm that recently opened a new office in Dallas, one of several PE firms that have set up shop in Texas. The Lawbook’s Claire Poole had a chance to chat with Darryl Smith, who heads the new Texas outpost, about the company’s market outlook and what their presence might mean for lawyers in the Lone Star State.

Two Houston Lawyers Score Three M&A Deals Each in the Past Month

It’s been a busy time for mergers and acquisitions in Texas, particularly in the oil and gas industry. And over the last month or so, two Houston lawyers each handled three large transactions that together were worth more than $21 billion. The lawyers who put those deals together talked to The Lawbook’s Claire Poole about how those deals came about.

Mergermarket: Goldman Sachs, JP Morgan Lead Financial Advisors in Texas M&A

The Texas Lawbook has exclusive top 30 rankings of financial advisors in mergers and acquisitions involving Texas-based companies. Mergermarket data shows that 15 investment banks worked on 10 deals or more.

Akin Gump Counsels Longtime Client Cimarex on $1.6B Resolute Purchase

In the latest of a wave of billion-dollar-plus mergers between oil and gas producers, Denver-based Cimarex Energy Co. announced Monday that it agreed to buy crosstown company Resolute Energy Corp. for $1.6 billion, including debt. Texas lawyers from Akin Gump were involved, and The Lawbook’s Claire Poole has those details.

V&E, Bracewell, Baker Botts Assist on Anadarko’s Western Gas Transactions

Anadarko Petroleum Corp. announced Thursday that it agreed to sell almost all of its remaining midstream assets to affiliate Western Gas Partners for $4.015 billion, and three Texas law firms were involved. Claire Poole has the names and details.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 42

- Go to page 43

- Go to page 44

- Go to page 45

- Go to page 46

- Go to page 47

- Go to Next Page »