DBJ: Another Dallas Investment Firm Raising More than $1B for New Fund

Dallas private equity financier Newstone Capital Partners is aiming to raise $1.25 billion for a fourth fund, according to a recent regulatory filing.

Free Speech, Due Process and Trial by Jury

Dallas private equity financier Newstone Capital Partners is aiming to raise $1.25 billion for a fourth fund, according to a recent regulatory filing.

There are lots of reasons for mergers and acquisitions: to simplify corporate structure; to diversify product mix; to extend geographic reach. There is also the need for cash: to pay down debt, to boost shareholder return or to invest in lucrative prospects. In her Top 10 Texas M&A Deals, Claire Poole found an array of those motives on display in 2018.

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession.

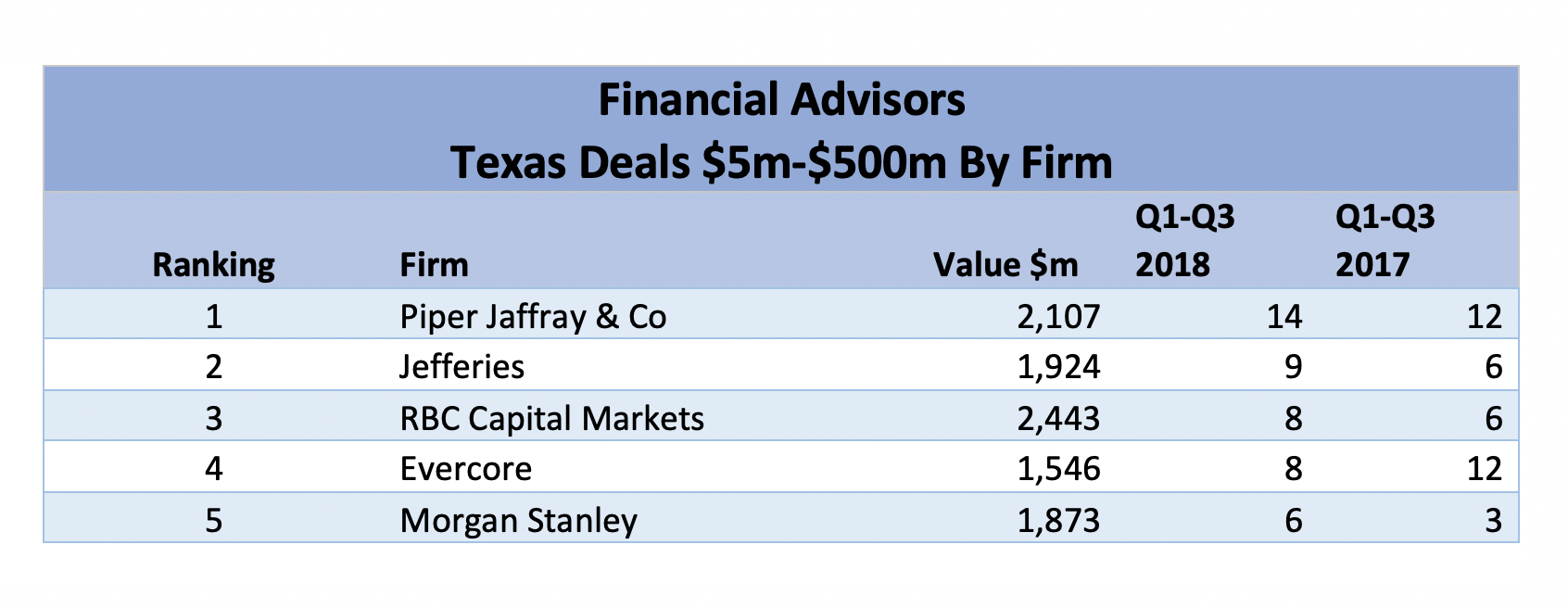

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession. Here's how financial advisors are stacking up through Q3.

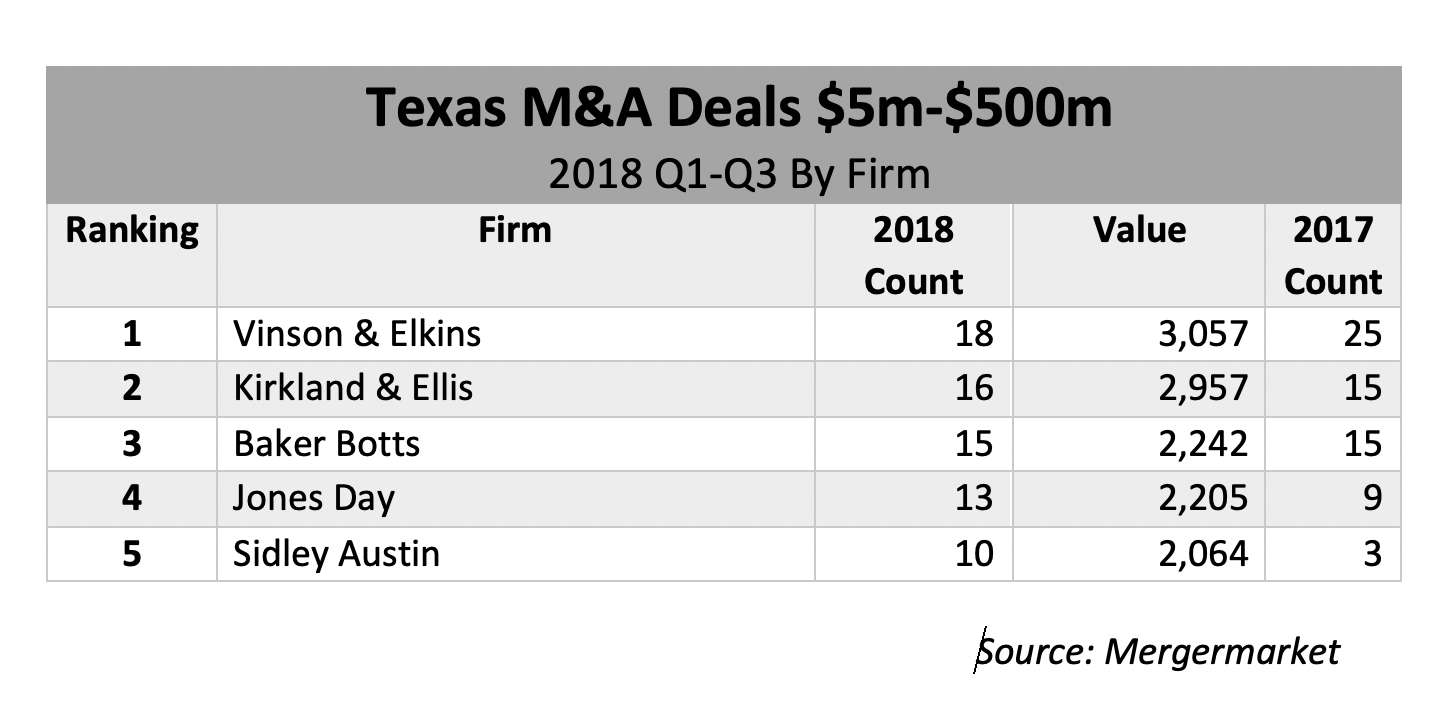

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession. Click here for an expanded chart of how law firms stack up by deal count in the mid-market so far this year.

Fourth quarter mergers and acquisitions involving middle and lower middle market Texas businesses have hit an unexpected low. Texas lawyers say their businesses are currently thriving, but the drop shouldn't necessarily be ignored. Claire Poole and Mark Curriden have their insights on a perplexing end for 2018.

Skyview is a Los Angeles-based private equity firm that recently opened a new office in Dallas, one of several PE firms that have set up shop in Texas. The Lawbook's Claire Poole had a chance to chat with Darryl Smith, who heads the new Texas outpost, about the company’s market outlook and what their presence might mean for lawyers in the Lone Star State.

It’s been a busy time for mergers and acquisitions in Texas, particularly in the oil and gas industry. And over the last month or so, two Houston lawyers each handled three large transactions that together were worth more than $21 billion. The lawyers who put those deals together talked to The Lawbook's Claire Poole about how those deals came about.

In the latest of a wave of billion-dollar-plus mergers between oil and gas producers, Denver-based Cimarex Energy Co. announced Monday that it agreed to buy crosstown company Resolute Energy Corp. for $1.6 billion, including debt. Texas lawyers from Akin Gump were involved, and The Lawbook's Claire Poole has those details.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.