Greenberg Traurig Gets Dallas, Austin Deal Lawyers

Gemma Descoteaux and Kurt Lyn have joined Greenberg Traurig from Sheppard Mullin and Kirkland & Ellis, respectively.

Free Speech, Due Process and Trial by Jury

Gemma Descoteaux and Kurt Lyn have joined Greenberg Traurig from Sheppard Mullin and Kirkland & Ellis, respectively.

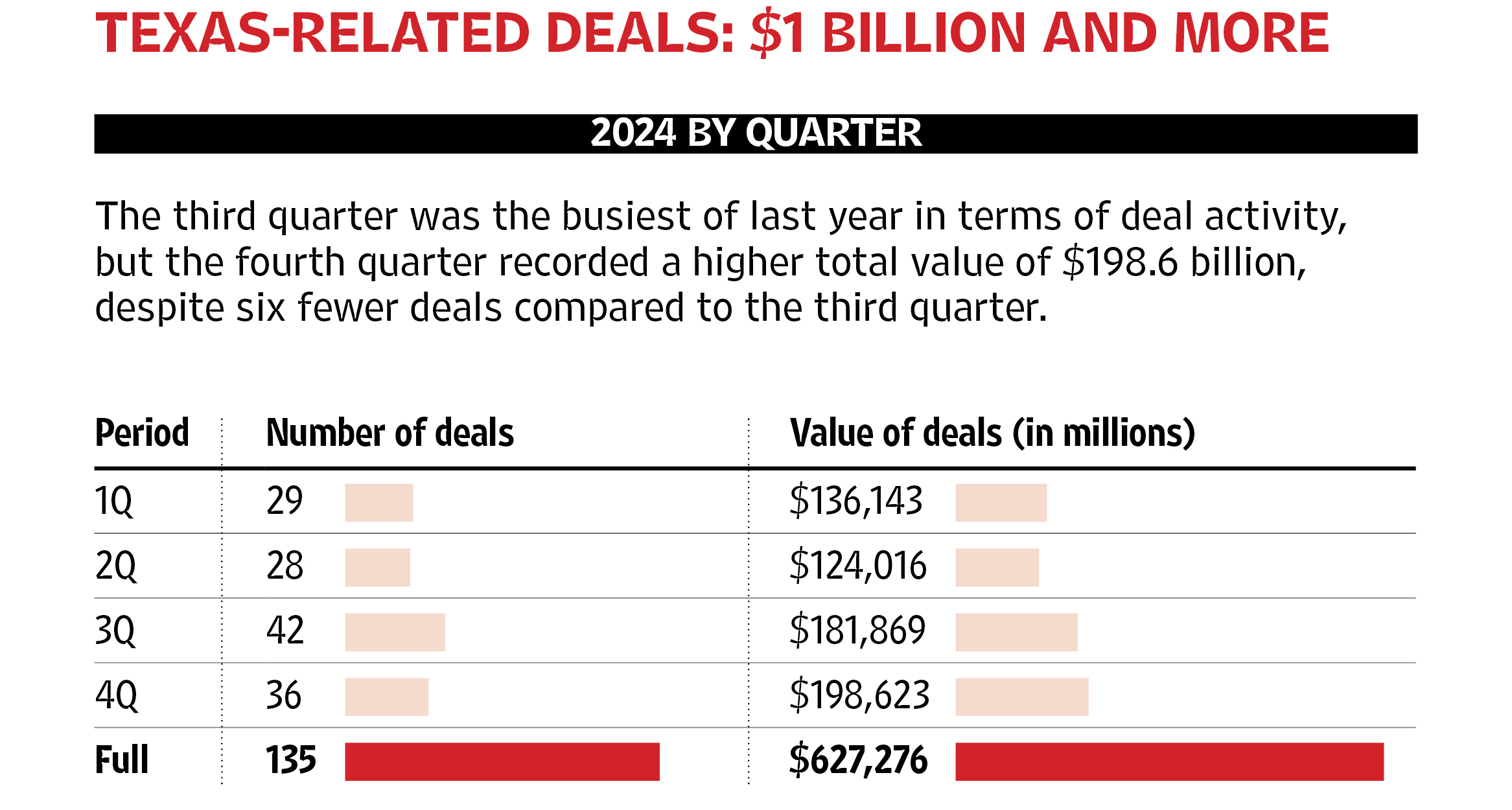

Last year, there were 135 Texas-related deals (one that involves a party headquartered in Texas or advised by Texas-based lawyers) submitted to The Texas Lawbook's exclusive Corporate Deal Tracker that reached or broke the $1 billion barrier — some of them by a lot. The deals had an aggregate value of $627.2 billion, slightly below 2023 but much higher than in 2021, the record year of rebounding from the pandemic, against which many firms have measured the market in recent years.

There have been a number of utility/power deals in recent weeks, but none that seemed more significant than Constellation Energy's $26.6 billion acquisition of Houston's Calpine Energy. The deal is significant, not only for its size, but for what it says about our understanding of energy transition. Coupled, of course, with the usual CDT Roundup survey of last week's Texas-related energy transactions.

This is our list, a roster of transactions that caught our attention this year among the more than 2,000 Texas-related transactions submitted to the Corporate Deal Tracker in 2024. These "Texas-related" deals are transactions that involve either Texas-headquartered parties, Texas-based lawyers or, better yet, both.

In one of the largest ever green energy generation transactions, Constellation Energy has agreed to acquire Calpine Corporation, a Houston-based natural gas and geothermal energy provider taken private by Energy Capital Partners in 2018. Lawyers from Kirkland, Gibson Dunn, Latham and White & Case are advising on the deal.

The deal, which includes two fractionalization facilities and more than 1,300 miles of pipeline, expands P66 capacity to move NGL from production points across the Permian Basin to Gulf Coast refineries.

Bryan L. Clark was Pioneer Natural Resources’ primary marketing and midstream counsel and also served as lead counsel on energy transition matters.

With a new year upon us, it's a time for reflection and evaluation. You know what we mean: numbers. Here at the CDT Roundup, in case you haven't noticed, we believe in numbers. We worship numbers. Even our headlines are numbers — with just enough words to let you know what we are counting: "Deals, Firms, Lawyers, Money." But we also keep track of the numbers we write about.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.