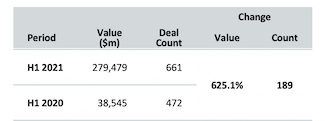

Goldman, JPMorgan Rule H1 2021 League Tables

Exclusive data from Mergermarket breaking down the leaderboard for financial advisors showed two new top dogs for deal value and count for the first half of 2021. Here's a look at which firms are commanding the league tables so far this year.