CDT Roundup: 14 Deals, 11 Firms, 124 Lawyers, $4.009B

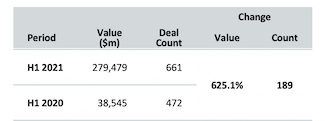

Mergermarket data provided exclusively to The Texas Lawbook shows that deal flow quarter over quarter continued at a rapid clip in the first half of the year, but the deal values came with a heftier price tag in Q2. And in this week's Corporate Deal Tracker Roundup, July continues to lag – though nothing new based on comparative data.