With a new year barreling in, what do we expect of 2019? Well, maybe a slow start, at least in IPOs. New issues are likely down for 2018, and though their value is up, that might not continue. Still, in a slow starting season there are a few issues that may hit the market soon. The Lawbook’s Claire Poole has the names and numbers in her weekly CDT Roundup

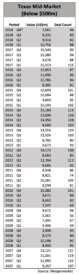

Mid-Market YTD 2018: Law Firms

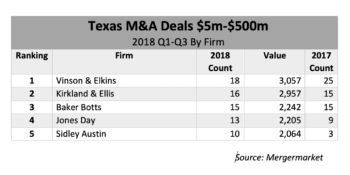

Middle market M&A has been eroding across the nation, and even in the otherwise thriving Texas market Texas-headquartered firms will likely finish 2018 with less than 200 mid-range transactions for the first time since the Great Recession. Click here for an expanded chart of how law firms stack up by deal count in the mid-market so far this year.

CDT Roundup: 15 Deals, 16 Law Firms, 65 Texas Lawyers, $1.8B

Healthcare-centered private equity is on the brink of another record year. According to newly released data from Preqin, 585 healthcare-related deals had been announced through November worth $56 billion. The Lawbook’s Claire Poole explains how Texas dealmakers fit into the picture, along with her weekly assessment of Texas deals.

Does An Unexpected Mid-Market Low Mean Trouble For M&A? Maybe. Maybe Not.

Fourth quarter mergers and acquisitions involving middle and lower middle market Texas businesses have hit an unexpected low. Texas lawyers say their businesses are currently thriving, but the drop shouldn’t necessarily be ignored. Claire Poole and Mark Curriden have their insights on a perplexing end for 2018.

CDT Roundup: 12 Deals, 10 Law Firms, 90 Texas Lawyers, $7.5B

The energy sector is, and probably always will be, the leader in deals made in Texas. But don’t forget about technology. Tech is the third largest business sector for deals in Texas, and its influence is growing. The Lawbook’s Claire Poole has the tech deal numbers along with last week’s overall dealmaking.

GC Ryder Leads Nexstar’s $6.4B Purchase of Tribune Media

Irving-based Nexstar Media Group Inc. will become the largest owner of local TV stations in the U.S. after its $6.4 billion acquisition of Tribune Media Co. announced Monday. The Lawbook’s Claire Poole discussed the deal with Nexstar GC Elizabeth Ryder who led the transaction.

Skyview Capital’s Darryl Smith: Looking to Tap Texas Market for Carve-outs

Skyview is a Los Angeles-based private equity firm that recently opened a new office in Dallas, one of several PE firms that have set up shop in Texas. The Lawbook’s Claire Poole had a chance to chat with Darryl Smith, who heads the new Texas outpost, about the company’s market outlook and what their presence might mean for lawyers in the Lone Star State.

CDT Roundup: 15 Deals, 11 Law Firms, 110 Texas Lawyers, $4.5B

Heading into the thick of the holiday season, as well as the year’s end, two separate trends may be emerging: first, middle market deals are beginning to thin; second, PE is gaining influence fast enough to account for half the M&A market in the next five years. The Lawbook’s Claire Poole explains in her weekly Corporate Deal Tracker Roundup.

Two Houston Lawyers Score Three M&A Deals Each in the Past Month

It’s been a busy time for mergers and acquisitions in Texas, particularly in the oil and gas industry. And over the last month or so, two Houston lawyers each handled three large transactions that together were worth more than $21 billion. The lawyers who put those deals together talked to The Lawbook’s Claire Poole about how those deals came about.

Akin Gump Counsels Longtime Client Cimarex on $1.6B Resolute Purchase

In the latest of a wave of billion-dollar-plus mergers between oil and gas producers, Denver-based Cimarex Energy Co. announced Monday that it agreed to buy crosstown company Resolute Energy Corp. for $1.6 billion, including debt. Texas lawyers from Akin Gump were involved, and The Lawbook’s Claire Poole has those details.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 92

- Go to page 93

- Go to page 94

- Go to page 95

- Go to page 96

- Interim pages omitted …

- Go to page 113

- Go to Next Page »