Most alternative investors are sticking to their long-term plans despite the coronavirus, although they differ on when business will return to normal, while deal flow involving Texas lawyers continues to trend upward.

CDT Roundup: 15 Deals, 10 Firms, 90 Lawyers, $10.4B

The capital markets continued to provide more solid companies with the cash they need to keep going through the coronavirus pandemic.

Southwest Airlines Raises Another $6B

Three large capital markets transactions – plus last week’s $3.2 billion in funding from the federal government – bring the Dallas airline’s total cash haul to more than $9 billion.

Law Firms’ M&A Deal Work Declines Significantly

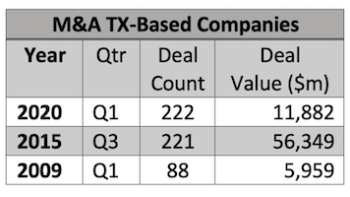

Twelve of the top 15 corporate M&A law firms operating in Texas did fewer deals during Q1 2020 than they did a year ago, according to new Mergermarket data. But the Corporate Deal Tracker shows the decline in deal activity for Texas lawyers started dropping a year ago. The Texas Lawbook has an in-depth look at the M&A deal work being done by lawyers in Texas.

Texas Lawyers’ Capital Markets Deals Down Nearly 25% in 2019

Blame the oil and gas industry, which even before the market collapse had difficulty attracting funding given its out-of-favor status on Wall Street.

Morgan Stanley Holds Top Spot in Q1 Dealmaking Value in Texas

Houlihan Lokey ranked-one in deal count, handling 11 transactions in the state. Claire Poole reports on the latest exclusive Mergermarket numbers.

CDT Roundup: 19 Deals, 14 Firms, 92 Lawyers, $9.5B

Last week was a big one for capital markets transactions, in spite of…well, everything. M&A? Not so much. In her weekly CDT Roundup, Claire Poole has names and numbers for the deals that kept Texas lawyers busy while they WFH.

Texas M&A Falls Dramatically in Q1

For 51 consecutive quarters, energy was the dominant sector for M&A in Texas. That streak ended during the first three months of 2020, as M&A activity plunged in deal value to levels not witnessed since the Great Recession. Not one of the seven biggest-dollar Texas deals had anything to do with oil and gas, according to Mergermarket. The Texas Lawbook has the details.

CDT Roundup: 12 Deals, 9 Firms, 40 Lawyers, $6B

Deals are being terminated or renegotiated all over the place due to the coronavirus and fallen oil prices, with one seller in Texas taking a 30% haircut. Meanwhile, deal activity among Texas lawyers is beginning to slide with no letup in sight.

Dwindling Oil Storage Capacity and Impacts on Energy Companies

Commodity prices fell precipitously in the first quarter of 2020 as crude producers are getting hit on both the supply and demand sides. The U.S. is reportedly only weeks away from running out of crude oil storage capacity. Many E&P and midstream companies are evaluating whether to reduce production or pipeline capacity and/or shut in wells. The issue became more urgent last weekend when the Texas Railroad Commission reported that some oil companies are already receiving letters from shippers demanding production cuts and citing the unavailability of storage capacity.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 31

- Go to page 32

- Go to page 33

- Go to page 34

- Go to page 35

- Interim pages omitted …

- Go to page 47

- Go to Next Page »