This week, The Texas Lawbook published new Corporate Deal Tracker data showing M&A lawyers were busier during the first six months of 2022 than they have ever been. The article quoted several of the state’s leading dealmakers on the trends they saw during H1 2022. Now, we asked those same M&A lawyers to look into their crystal balls for the second half of the year? The bottom line: Opinions differed.

CDT Roundup: 11 Deals, 10 Firms, 92 Lawyers, $801M

Rumblings of a couple of deals in the offing involving properties owned by ConocoPhillips and Shell provided a touch of piquance to a week that was otherwise bland to the taste. The Roundup offers a few hints at what those deals might be, as well as its weekly run-down of the deals that actually happened, including the names of the Texas lawyers they involved.

Shell USA acquires Shell Midstream Partners for $1.96B

Shell USA announced Monday that it is paying $1.96 billion to acquire all outstanding stock of its subsidiary Shell Midstream Partners, which has assets involved in crude oil and refined products pipelines and terminals that serve as key infrastructure to transport onshore and offshore crude oil production to U.S. Gulf Coast and Midwest refining markets. The entities chose Houston lawyers from Baker Botts and Gibson Dunn as its legal advisors. The Lawbook has lawyer names and other details.

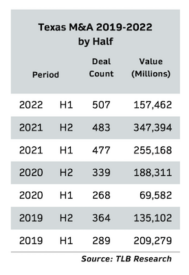

Texas M&A Dealmaking Hits Another Record in H1 2022

Texas Corporate dealmakers thought there was no way 2022 could match the record number of M&A transactions they handled in H1 or H2 2021 – both were records. But new data from by The Texas Lawbook’s Corporate Deal Tracker shows M&A activity hit another record high during the first six months of 2022 – albeit by an inch or so.

The dollar value of transactions declined significantly from the year before because there were no megadeals announced by the likes of AT&T, Chevron or Match.com. As you might expect, the energy sector led the way. The Texas Lawbook has the data and insight from the experts.

Clifford Chance Lands Veteran V&E Tech Partner

The Magic Circle law firm has recruited Devika Kornbacher to be the co-chair of its global technology group. Kornbacher, who had a hand in almost every tech deal at V&E, started her career at the Houston-based firm and practiced there for 15-plus years.

CDT Roundup: 14 Deals, 10 Firms, 122 Lawyers, $3.7B

The value of upstream energy deals is down in the second quarter of 2022, according to Enverus; down compared to the first quarter of 2022 and down dramatically from the same period a year ago. The reason seems simple: an abundance of caution in a volatile economic climate. The CDT Roundup has the numbers and the analysis, as well as the weekly roll call of the Texas lawyers behind last week’s deals.

Dealmaker Hugh Tucker Joins Haynes Boone

Tucker, who helped open Shearman & Sterling’s office in Houston after 35 years at Baker Botts, has advised on a host of big deals in the energy space.

CDT Roundup: 11 Deals, 8 Firms, 71 Lawyers, $3.58B

In a generally weak week for dealmaking, it was easy to notice that Kirkland & Ellis partner Rahul Vashi has been on a tear of late with four deals in the past week or so. The CDT Roundup has Vashi’s view on how to keep multiple deal streams in order, and what he expects in the near future from a volatile deal market, as well as the usual list (however short) of the other lawyers who have been making things happen.

Stonepeak Picks Up Part of CoreSite from American Tower for $2.5B

Sidley Austin advised the private equity firm, including partner Tim Chandler, who also led its sale of thermal power generation projects in New England to Japan’s JERA in May for undisclosed terms.

New Fortress, Apollo Join in $2B LNG Venture

The platform will be 80 percent owned by the private equity giant and 20 percent owned by the company, freeing up capital that can be used elsewhere.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 43

- Go to page 44

- Go to page 45

- Go to page 46

- Go to page 47

- Interim pages omitted …

- Go to page 113

- Go to Next Page »