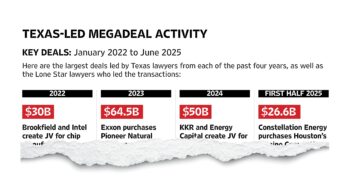

2023 — The Year of Billion-Dollar M&A Deals in Texas

The size of a deal may not always be an indicator of its success, but 2023 in Texas will certainly go down in history as the year of some massive billion-dollar transactions. Despite the fact that the global M&A market saw a 17 percent decline in value and 6 percent decline in volume, Texas had the distinction of leading the world with the two largest megadeals: ExxonMobil's $64.5 billion acquisition of Pioneer Natural Resources and Chevron's $60 billion purchase of Hess Corp. Even ONEOK's $18 billion acquisition of Magellan Midstream Partners made it to the top dozen deals worldwide, as Texas demonstrated its energy prowess across the globe.