Texas M&A: A Bottom-Heavy Market…For Now

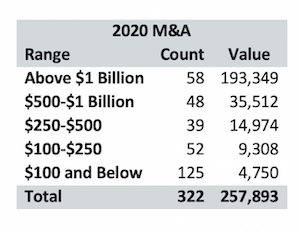

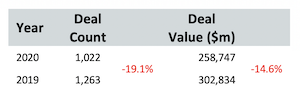

When you're looking at Mergermarket stats on deals by Texas companies or Corporate Deal Tracker stats on deals handled by Texas lawyers, 2020 looks pretty much the same: more than two-thirds of last year's deals were worth less than $500 million.

Caroline Evans explains the significance of that fact.