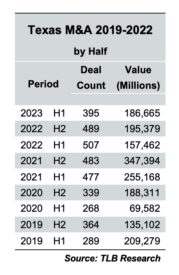

The Texas deal numbers are in for the first half of 2023, and according to The Texas Lawbook’s exclusive Corporate Deal Tracker they aren’t especially pretty. But beneath the surface lies a sense among Texas dealmakers that the money is still there, that investors are more disciplined and that deals with legs are simply more complicated and creative and, above all, still part of a vibrant economic pipeline.

More Stories

Litigation Roundup: Oral Arguments Set in Paxton Disciplinary Case, Fifth Circ. Won’t Rehear En Banc ‘State Created Danger’ Case

In this edition of Litigation Roundup, the Dallas Court of Appeals sets the panel and date for oral arguments in the state bar’s disciplinary lawsuit against Ken Paxton, an oilfield services company’s trade secrets suit against its ex-president gets rolling and an East Texas jury hits LG with a $1.68 million patent infringement verdict.

In Wake of Harvard Supreme Court Decision, Kanarys Founder Provides Practical DEI Tips

As higher education circles, prospective students of color and mainstream media grapple with the aftermath of the Supreme Court’s affirmative action decision, so too does the legal industry. The Lawbook wanted a DEI expert’s take and got input from Kanarys founder Mandy Price, a Big Law attorney-turned DEI guru.

Dallas Lender Owes Millions for Wrongful Foreclosure in ‘Business Coup D’état’ Case

Dallas County District Judge Monica Purdy presided over a seven-day bench trial in May before determining that PrimaLend violated the terms of a loan agreement when it changed the locks and foreclosed on an Ohio car dealership before first exhausting attempts to recover its money by pursuing the business’ assets. Judge Purdy is expected to enter final judgment awarding the Benit family about $6.7 million within the next week.

ExxonMobil Inks Deal to Buy CO2 Pipeline Operator Denbury for $4.9B

The transaction, which has been rumored about since last fall, reflects the oil giant’s push to expand its low-carbon solutions business.

How SCOTUS ‘Shook the Rails’ on State Court Jurisdiction

The U.S. Supreme Court’s recent ruling in Mallory v. Norfolk Southern has the potential to bring forth the most fundamental shift in jurisdictional case law in decades. The decision opens the doors for new state laws expanding their courts’ jurisdictional reach. Businesses operating in Texas must grapple with this uncertainty and the accompanying risks it presents.

Gibson Dunn Adds Tax Depth in Houston

Hillary Holmes, co-head of Gibson Dunn’s Houston office, said Greg Nelson’s “deep tax expertise, particularly in the energy industry, will be of immense value to our clients.” Nelson most recently led the Houston office of Paul Hastings, but worked with Holmes for nearly a decade at Baker Botts.

CDT Roundup: 16 Deals, 12 Firms, 172 Lawyers, $5.4B

A new report from Refinitiv suggests that bankers are hurting these days. Investment banking fees are down during the first six months of 2023 — off 18 percent from 2022, year-over-year, and the lowest since 2016. Advisory fees from M&A fared even worse. The culprits include U.S. involved M&A, which has been lagging in both volume and value. The Lawbook’s Claire Poole looks at the underlying stats, including a few sectors that have thrived, even during the current lag — and, of course, the usual roll call of deals reported by Texas lawyers last week.

K&S Lands Houston Litigator from GT

Mary-Olga Lovett, a member of Greenberg Traurig’s global executive committee, has taken her decades of trial experience to King & Spalding.

14 Charged in Dallas in $53M Covid Payroll Loan Scheme

“Defrauding the government is an affront to American taxpayers,” says Leigha Simonton, U.S. attorney in Dallas. “Defrauding the government during a pandemic — at a time when millions of hardworking entrepreneurs struggled to make payroll and rent — is pouring salt in a wound.”