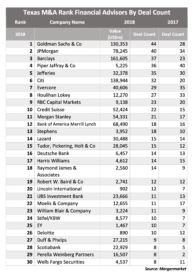

Barclays and Goldman Sachs top the 2018 league tables for investment banks advising on Texas deals. But the real story in exclusive Mergermarket data provided to The Texas Lawbook may be the trend toward fewer but bigger deals in the state and elsewhere. Claire Poole explains.

More Stories

Lawyer Discipline: State Bar of Texas

The State Bar of Texas has announced its most recent disciplinary actions. According to the state bar, five judges were disciplined, including one judicial suspension. In addition, seven Texas lawyers were suspended and two more received public reprimands.

Crawford, Wishnew & Lang Expands Employment Expertise with New Lateral

Dallas employment law expert Emily Stout on Friday moved her practice from Clouse Brown to Crawford, Wishnew & Lang. Stout’s lateral move makes her the eighth attorney to join CWL since the litigation boutique opened its doors in February 2018.

WATCH THIS SPACE! Coming Soon: Texas Supreme Court pronouncements on significant issues of contract interpretation and enforcement

Early in December the Texas Supreme Court heard oral argument in three cases in which the Court likely will render important guidance as to key issues for contract interpretation and the interplay between contract and fraud claims. Ray Guy of Weil, Gotshal & Manges reviews the background of those cases and the key questions they present.

Remembering Nancy Dunlap: 1946-2019

Nancy Dunlap, general counsel at Rosewood Properties Corporation, died on January 21. We asked longtime friend and colleague Alan Loewinsohn about her. His response was thoughtful and warm.

Mergermarket: Kirkland, then V&E Dominate Texas M&A

Locked in a five-year battle with V&E for top M&A firm in Texas, Kirkland represented more Texas-based companies in 2018 than any law firm in Texas history. New Mergermarket rankings show a growing separation between Kirkland and V&E, and even more separation between V&E and the rest of the pack. The Texas Lawbook has the details.

Baker Botts, V&E, Sidley, Latham Aid on Blackstone’s $3.3B Acquisition of Tallgrass

Blackstone Infrastructure Partners is acquiring a controlling interest in Tallgrass Energy for $3.3 billion. The purchase shows that private investors continue to have strong interest in the oil and gas industry despite lower commodity prices, particularly in the infrastructure part of the sector. Claire Poole reveals the names of lawyers and firms involved.

Remembering Darrell Jordan, Leader of the Legal Profession

Darrell Jordan, one of the all-time great Texas lawyers and counsel to scores of business leaders for five decades, died Wednesday. He was 80. A former basketball player at UT, Jordan argued a landmark case before the U.S. Supreme Court and advocated zealously for legal aid for the poor and equal access to justice.

Norton Rose Fulbright Taps Austin Partner as Joint Global Head of Real Estate Practice

Austin partner Jane Snoddy Smith has been appointed joint global head of real estate with London partner Dan Wagerfield.

AZA Mints Four Partners

Three of the four graduates are UT Law alumni.