Atlas Technical Agrees to $1.05B Buyout by GI Partners

Kirkland counseled the Austin-based company, which provides infrastructure and environmental solutions to U.S. markets.

Free Speech, Due Process and Trial by Jury

Kirkland counseled the Austin-based company, which provides infrastructure and environmental solutions to U.S. markets.

Though 2022 has been a relatively slow year for bank deals across the U.S. after a record-breaking amount of activity the year prior, a possible recession could create an environment ripe for mergers and acquisitions. Veteran bank deal lawyer Sandy Brown of Alston & Bird talked with the Dallas Business Journal about what 2023 might bring.

The Mergermarket year-end polling is out and the results are optimistic. More than 60 percent of decision-maker respondents from 300 corporate and PE firms predict overall increases in M&A, despite the ongoing threat of inflation and continued geopolitical challenges. The CDT Roundup has details of the survey, as well as which markets they are predicting will prosper. As always, there are the names of Texas lawyers who advised on 14 deals reported last week.

There are several unique liability issues associated with the purchase of an employee stock ownership plan company which are often overlooked by the purchaser. This article discusses some of the unique liability issues in order to avoid any surprises post-transaction, as well as possible solutions to address these issues.

Last month Texas Capital Bank closed a $3.4 billion sale of its insurance premium finance unit, BankDirect Capital Finance. At the center of that transaction was Anna Alvarado, general counsel of TCB. In a Q&A with Claire Poole, Alvarado discusses that deal, her views on lawyers in the banking business and the steep trajectory of a work life that began picking grapes.

A team led from Houston advised the airline in a widebody aircraft inventory overhaul that will include as many as 200 Boeing 787s over the next decade. Along with earlier announced acquisitions, the company says it will be accepting delivery of some 700 new aircraft, averaging delivery of as many as two per week in 2023.

There's no surprise in the fact that global PE deals are down. With inflation, market volatility and geopolitical concerns, investors have become increasingly cautious and borrowers increasingly concerned, according to a new Mergermarket report. But there are also indications that some underlying changes are taking place in the PE pipeline. This week's CDT Roundup has more on the Mergermarket survey, as well as the usual roster of lawyers who reported deals last week.

You may remember traditional IPOs — those initial public offerings popular before the market eruption of SPACs. Are they making a comeback? Maybe. A $2 billion IPO announced this week by BKV Corp. may hold a clue to the future. But in any case, BKV's recent acquisition tear makes it worth watching. The CDT Roundup has more on that BKV deal, as well as the names of Texas lawyers who announced deals during a holiday-shortened week.

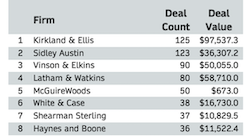

The Texas lawyers at 12 corporate law firms were involved as lead counsel in 20 or more M&A deals during the first nine months of 2022. Four firms were lead legal advisors in more than 60 deals. One firm saw its attorneys in Austin, Dallas and Houston hit triple digits in deal count for lead legal advisors during the first three quarters of 2022.

The Texas Lawbook has released its exclusive Corporate Deal Tracker M&A law firm rankings for Jan. 1 through Sept. 30. The mission is to document transactional work done by lawyers in the Lone Star state.

Whatever its purpose or intent, a letter from five GOP senators to 51 lawyers involved in ESG transactions at their firms was mystifying to those who would talk about it. Sent five days in advance of the recent mid-term elections, the threatening tone of the letters was in keeping with a series of attempts to curb, through their lawyers, corporate support for environmental mandates, energy transition investments and changes in corporate governance — despite increasingly vocal and influential investor demand.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.