The first six months of 2020 downright sucked for corporate M&A law firms. New Mergermarket data shows that 11 of the top 12 corporate practices did fewer transactions involving Texas-based businesses than they did the year before. For the first time in 13 years, no firm reported working on at least 30 Texas transactions. The Texas Lawbook has the law firm rankings.

M&A Hits Lowest Mark Since 2009

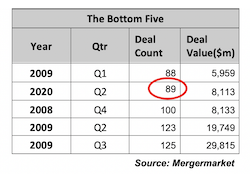

UPDATED: Texas-headquartered dealmaking has plummeted to historic levels in 2020. The second quarter had only 89 deals, only one more than Q1 2009, at the nadir of the Great Recession. The Texas Lawbook has the numbers and they include a nearly 94% drop in year-over-year value from 2019.

CDT Roundup: 8 Deals, 10 Firms, 50 Lawyers, $6.9B

The oil and gas industry is still reeling from “Black April” — when the NYMEX oil benchmark hit bottom and kept going. Last week two major price reporting agencies launched their own benchmarks aiming to solve the problem by setting the price of Texas oil in Texas.

Waste Management, Advanced Disposal Reboot Merger at $4.6B

In addition to a reduced price, the two companies agreed to sell $835 million in assets, including some likely required for DOJ antitrust clearance.

CDT Roundup: 12 Deals, 9 Firms, 115 Lawyers, $4.44B

We know you’re worried that oil is still hovering stubbornly around $40bbl. But as the weekly CDT Roundup explains, it could be worse: you could be in retail.

CDT Roundup: 6 Deals, 5 Firms, 37 Lawyers, $3.6B

Maybe misery doesn’t always love company. But every once in a while it does enjoy taking inventory. Allen Pusey, standing in for Claire Poole, explains in this week’s roundup.

CDT Roundup: 8 Deals, 7 Firms, 48 Lawyers, $7.34B

In weeks when good news looks good by simply not being apocalyptic — slower coronavirus death rates, modest reopening of public spaces, oil prices above zero — you’re just going to have to lower your standards. Keep that in mind when you’re hunting for good news in this week’s CDT Roundup.

CDT Roundup: 2 Weeks, 10 Deals, 8 Firms, 68 Lawyers, $742.4M

Word this week that a $5.5 billion bank merger was scrubbed in the wake of the coronavirus pandemic may only be the beginning of the bad news from the Corporate Deal Tracker. ‘Buckle up’ is the lesson gleaned from this week’s belated report. Be sure to see a note about that and the absence — for the moment — of our friend and colleague, Claire Poole.

DBJ: Dallas Firm Closes $969M Fund

Baker Botts represented Energy Spectrum Partners in its VIII fund, which will continue to invest primarily in midstream assets in the energy sector.

DBJ: As Dealmaking Stalls, Distress Could Create Opportunities for the Bold in DFW PE

The Dallas Business Journal’s Rebecca Ayers talked with Foley partner Chris Converse and other dealmakers about the challenges and opportunities facing private equity.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 30

- Go to page 31

- Go to page 32

- Go to page 33

- Go to page 34

- Interim pages omitted …

- Go to page 47

- Go to Next Page »