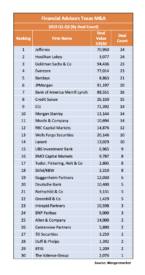

Other bulge-bracket banks also ranked highly, showing that those with heft and a record of leadership are winning deal business despite the slowdown in activity in Texas.

CDT Roundup: 8 Deals, 8 Firms, 138 Lawyers, $6.6B

Private equity activity has slowed down this year while M&A involving Texas lawyers did the same this past week. Consolidation continued in the Permian Basin, private equity-backed midstream developers found exits and a big oil company divested a big asset while another expanded in a new growth area.

CDT Roundup: 19 Deals, 14 Firms, 55 Lawyers, $4.3B

Lawyers talked trends at UT Law School’s M&A Institute last week, from reps and warranties insurance to deal flow, while transaction activity kept humming along. Claire Poole reports.

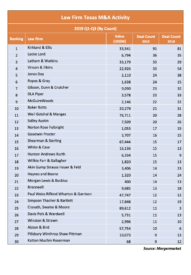

Texas M&A Dealmakers in 2019: Kirkland & Everyone Else (updated)

In a year when mergers, acquisitions and joint ventures in Texas are down significantly, lawyers at Kirkland & Ellis are actually expanding their position as the go-to M&A law firm for businesses in the state. M&A activity declined or was stagnate at 17 of the top 30 corporate law firms during the first nine months of this year, according to Mergermarket. Five firms are down double-digits in deal count from 2018. Kirkland is the only firm in the top 30 up double-digits. The Texas Lawbook has the details.

M&A Down Substantially in Texas in Q3

While the deal count stayed above 200 in the third quarter, it was the lowest level over a 12-year period since the second quarter of 2013. Observers blame trade wars and economic concerns as the culprits.

CDT Roundup: 19 Deals, 18 Firms, 132 Lawyers, $8.1B

Global M&A activity looks pretty sickly so far this year, falling 11% to $2.8 trillion – the slowest pace in more than two years, according to Refinitiv. But conditions may be turning around, with dealmaking among Texas lawyers hopping last week. Claire Poole reports.

Latham, V&E Advise on Roan Resources’ $1B Purchase by Warburg-backed Citizen

The offer represents a 24% premium for Roan, which was born out of the bankruptcy of Linn Energy and will be led by a former Linn executive.

Gibson Dunn Advises SK Innovation on $1.05B Peruvian Gas Field Sale to Pluspetrol

The South Korean seller plans to use the proceeds to diversify into other energy sectors and expand in Asia and North America.

Locke Lord, Orrick Assist on NextEra’s Purchase of Meade Pipeline from Cabot, Others for $1.37B

The transaction – which includes $90 million for expansion – comes as Appalachia’s Marcellus Shale continues to lack pipeline capacity to carry natural gas to market.

The Deals, The Law Firms, The Lawyers

Our expert team has examined every transaction recorded by the Corporate Deal Tracker – there were thousands of them handled by Texas lawyers in 2018 and 2019. This article details how The Lawbook plans to unveil the findings.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 35

- Go to page 36

- Go to page 37

- Go to page 38

- Go to page 39

- Interim pages omitted …

- Go to page 46

- Go to Next Page »