M&A 2021: A Year Beyond ‘Even the Wildest Expectations’

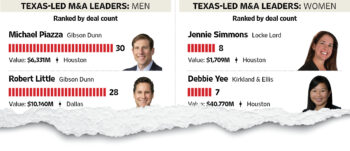

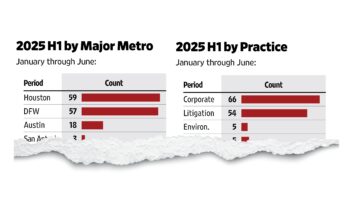

Texas M&A boomed in Texas in 2021 — in value, in deal count and in ways that bode well for 2022. According to exclusive data from The Texas Lawbook's Corporate Deal Tracker, each month of 2021 outperformed 2020 year-over-year. There were more deals at basically every level — for $1 million or $1 billion or beyond. Whether in energy or healthcare, construction or infrastructure, technology or transportation, it was a year that rebounded from the pandemic beyond the most optimistic expectations. The Lawbook has the numbers, the tables and the views of deal lawyers across the state of what was, from virtually any perspective, a very remarkable year.