Texas lawyers from three different firms had a hand in Denbury Resources’ $1.7 billion purchase of Penn Virginia Corp., the first of what’s expected to be a wave of mergers between publicly traded oil and gas producers. Claire Poole has the details in The Texas Lawbook.

CDT Roundup: 14 Deals, 18 Law Firms, 134 Texas Lawyers, $14.4B

The stocks of oil and gas exploration and production companies have been selling off recently, with one index down by around 18 percent so far this month. That’s led some industry observers to believe that mergers could begin to accelerate. And in Texas, there was a slight uptick in activity last week. The Lawbook’s Claire Poole has it covered.

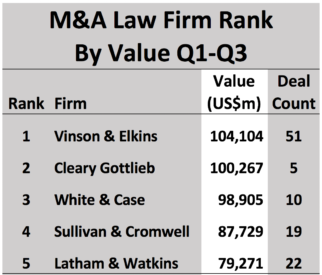

Mergermarket: V&E, White & Case, Latham Handle Biggest Value M&A Deals in TX

At the third quarter of 2018, Houston-based Vinson & Elkins ranks No. 1 in the combined value of their M&A transactions for Texas businesses. But exclusive data provided to The Texas Lawbook by Mergermarket shows the next 10 are headquartered outside Texas. In fact, four of the top 10 don’t even have an office in the state. More inside.

CDT Roundup: 13 Deals, 13 Law Firms, 126 Texas Lawyers, $6.14B

Texas dealmaking slowed a bit last week, but continued the recent brisk tempo. Don’t be surprised if there is a significant uptick in the making. The recently released Dykema survey reveals remarkable optimism for M&A activity in the coming year. The Lawbook’s Claire Poole explains.

Baker Botts aids WorleyParsons on $3.3B purchase of energy, chemicals and resources segment from Jacobs

Jacobs Engineering Group Inc. of Dallas announced Monday that it agreed to sell its energy, chemicals and resources segment to Australia-traded WorleyParsons Ltd. for $3.3 billion. The move makes WorleyParsons the world’s biggest provider of professional services in energy and resources. Claire Poole explains.

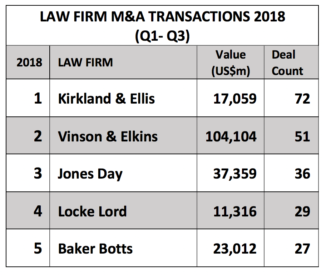

Kirkland, V&E Top M&A Legal Advisor Rankings in TX

New Mergermarket data provided exclusively to The Texas Lawbook shows that Kirkland & Ellis widened its lead in advising Texas companies involved in M&A activity during the first three quarters of 2018. V&E and Jones Day rank second and third. The Lawbook has the top 30 law firms by deal count.

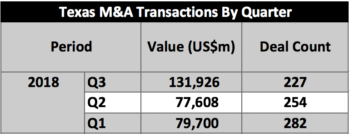

Mergermarket Data : Texas M&A Transactions Continue To Churn

Mergers and acquisitions involving Texas companies continue to be upbeat, with third-quarter deal value up almost 70 percent over the second to $131.9 billion, according to Mergermarket data provided exclusively to The Texas Lawbook.

Oncor Acquires InfraREIT in $1.275B Deal

Texas’ largest electricity transmission and distribution company, Oncor Electric Delivery Co., announced Thursday that it was acquiring InfraREIT Inc. for $1.275 billion and four law firms in Texas helped make the deal go.

Latham Partners with Houston Restaurant Week and the Houston Food Bank

“Our office has a strong history with the Houston Food Bank and we were honored to partner with them and Houston Restaurant Weeks to help provide over 40,800 meals to those in need. The Houston Food Bank works tirelessly for our community and we are happy to be a small part of their success.” – Tim Fenn, Latham’s Houston Office Managing Partner

CDT Roundup: 18 Deals, 15 Law Firms, 131 Texas Lawyers, $18.39B

Texas had a decent week for dealmaking last week, both in volume and value. But in the larger market there are signs that things might be slowing down.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 78

- Go to page 79

- Go to page 80

- Go to page 81

- Go to page 82

- Interim pages omitted …

- Go to page 97

- Go to Next Page »