Are your law firm deals included in the Corporate Deal Tracker’s M&A lawyer rankings? The Texas Lawbook has a new, easy, transparent way to find out. The Lawbook unveils its new CDT M&A Master Chart, which documents every transaction handled by lawyers in Texas. The process is simple. The deal data is quickly updated and accurate. Check out the details.

Two Big Deals, Three Law Firms, 16 Texas Lawyers, $3B

Kirkland and McGuireWoods advised on Brookfield’s $2 billion purchase of a quarter stake in Dominion’s LNG facility Cove Point while Baker Botts represented Innophos on its sale to One Rock for $932 million in cash and assumed debt.

Shearman, V&E, Kirkland Advise on DTE’s Pipeline Acquisition from Momentum, Indigo

The purchase comes at a busy time for midstream deals, including Golden Gate’s $600 million Hillstone sale to NGL, Energy Transfer’s $5.1 billion purchase of SemGroup and Plains’ and Magellan’s $1.438 billion sale of a BridgeTex Pipeline stake to pension fund manager Omers.

CDT Roundup: 19 Deals, 14 Firms, 55 Lawyers, $4.3B

Lawyers talked trends at UT Law School’s M&A Institute last week, from reps and warranties insurance to deal flow, while transaction activity kept humming along. Claire Poole reports.

Kirkland, V&E Counsel on Parsley Energy’s $2.27B Purchase of Jagged Peak

Analysts say that the deal is accretive on financial metrics that matter, their acreage positions in the Delaware Basin fit like a glove and the transaction’s synergies are significant.

Texas M&A Dealmakers in 2019: Kirkland & Everyone Else (updated)

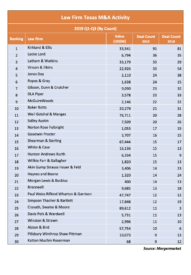

In a year when mergers, acquisitions and joint ventures in Texas are down significantly, lawyers at Kirkland & Ellis are actually expanding their position as the go-to M&A law firm for businesses in the state. M&A activity declined or was stagnate at 17 of the top 30 corporate law firms during the first nine months of this year, according to Mergermarket. Five firms are down double-digits in deal count from 2018. Kirkland is the only firm in the top 30 up double-digits. The Texas Lawbook has the details.

CDT Roundup: 18 Deals, 19 Firms, 166 Lawyers, $14.5B

M&A numbers may be down across the globe, but there is one sector that is holding its own: U.S. oil and gas. In her weekly Roundup Claire Poole explores the data along with last week’s deals involving Texas lawyers.

M&A Down Substantially in Texas in Q3

While the deal count stayed above 200 in the third quarter, it was the lowest level over a 12-year period since the second quarter of 2013. Observers blame trade wars and economic concerns as the culprits.

CDT Roundup: 19 Deals, 18 Firms, 132 Lawyers, $8.1B

Global M&A activity looks pretty sickly so far this year, falling 11% to $2.8 trillion – the slowest pace in more than two years, according to Refinitiv. But conditions may be turning around, with dealmaking among Texas lawyers hopping last week. Claire Poole reports.

Latham, V&E Advise on Roan Resources’ $1B Purchase by Warburg-backed Citizen

The offer represents a 24% premium for Roan, which was born out of the bankruptcy of Linn Energy and will be led by a former Linn executive.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 80

- Go to page 81

- Go to page 82

- Go to page 83

- Go to page 84

- Interim pages omitted …

- Go to page 113

- Go to Next Page »