Deals in the Oil Patch Still Reign Supreme for Texas Lawyers

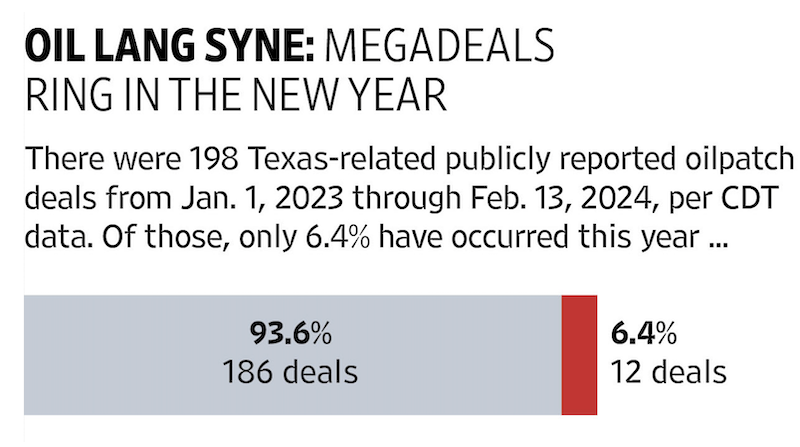

Corporate lawyers in Texas have been exceptionally busy over the last 13 months, as the surge in mergers, acquisitions and joint ventures within the oil patch remains robust.

Free Speech, Due Process and Trial by Jury

Corporate lawyers in Texas have been exceptionally busy over the last 13 months, as the surge in mergers, acquisitions and joint ventures within the oil patch remains robust.

Vinson & Elkins advised Chord and Latham & Watkins assisted Enerplus, a combination that analysts say will create a more formidable, acquisitive Williston-focused explorer and producer.

A policy "pause" in the expansion of LNG exports announced late last month by the Biden Administration came as a shock to many. U.S. LNG exports are not only regarded as strategic help for Western allies following the Russian invasion of Ukraine, but a viable climate-friendly alternative to coal. But life in the energy biz is never so simple, especially when it comes to fossil fuels. And this week's CDT Roundup takes a quick look at the factors that seems to have led to the pause, and the potential it could have on Texas M&A. That, and the usual review of last week's Texas-related corporate transactions.

Latham advised CenterPoint and Kirkland assisted Bernhard on the transaction, which is part of a broader trend by utilities disposing of their unregulated businesses.

Last week, The Texas Lawbook published the exclusive Corporate Deal Tracker ranking of law firms whose Texas lawyers handled the most mergers, acquisitions and joint ventures in 2023. Unfortunately, we missed 65 M&A transactions done by three law firms that were submitted to the CDT at the end of the year. We accidentally recorded one transaction as a $4 million deal when it was for $4 billion. The Lawbook withdrew the article from publication as soon as we recognized our error.

Texas lawyers at 19 firms worked on 25 or more deals in 2023. Eight law firms — Akin, Gibson, Dunn & Crutcher, Haynes Boone, Kirkland & Ellis, Latham & Watkins, Sidley Austin, Vinson & Elkins and White & Case — reported their lawyers in Texas worked on 50 or more transactions. Four law firms had lawyers in their Texas offices work on 100 or more M&A deals last year. The Texas attorneys at only two firms recorded total 2023 deal counts at 150 or more and deal values exceeding $150 billion. And the Austin, Dallas and Houston lawyers for a single law firm were lead or co-lead legal advisors for the buyers, sellers or targets in 140 deals — nearly twice as many as any other law firm, according to CDT data.

VC M&A has suffered from the same statis markets as any other kind of M&A. But it's been a while since the CDT Roundup has focused on startups, so this is the week. With the help of PitchBook, The Lawbook's Claire Poole takes a look at what those in the industry are predicting for the coming year. Are non-SPAC IPOs making a comeback? That, and a look at a rather raucous week of 26 pretty disparate deals and the lawyers who worked on them.

Paul Weiss and Vinson & Elkins counseled the privately owned Endeavor, whose 85-year-old founder has been considering selling.

A dozen years after first opening an office in Houston, Paul Hastings is making a concerted effort to expand its presence in Texas. The 1,100-lawyer corporate firm announced Monday three new capital markets partners — David Elder, Christopher Centrich and Patrick Hurley — have joined its Houston outpost from Akin Gump. The addition of the trio of lawyers comes six months after Paul Hastings hired complex commercial litigator Paul Genender away from Weil, Gotshal & Manges.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.