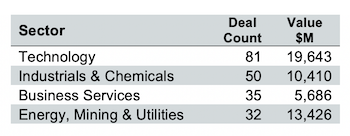

CDT Roundup: 21 Deals, 16 Firms, 125 Lawyers, $7.2B

As businesses small and large angle for growth in the post-pandemic future, decision makers are eyeing the best means to raise capital, rebound to pre-Covid levels and stave off worries of a 2021 recession, according to Truist. In this week's CDT, more than 120 lawyers took part in 21 deals.