Celanese Picks Up Materials Business from DuPont for $11B

Texas lawyers from Kirkland and Gibson Dunn advised the Dallas buyer on acquiring the business, which represented $3.5 billion of net sales and $800 million in operating earnings last year.

Free Speech, Due Process and Trial by Jury

Texas lawyers from Kirkland and Gibson Dunn advised the Dallas buyer on acquiring the business, which represented $3.5 billion of net sales and $800 million in operating earnings last year.

Four oil and gas partners weigh in on whether continued elevated oil prices will lead to more deal activity in the upstream and midstream sectors.

According to a report by Bain, the consulting firm, healthcare M&A was up by 16% in 2021 by volume but also up by 44% in value. The same can be said in Texas where healthcare deals proved both plentiful and interesting. More on that and the transactions reported last week in this latest CDT Roundup.

Vinson & Elkins advised the Dallas company after its $1.2 billion sale to Hong Kong-based Ant Financial in 2018 was blocked by U.S. regulators (the firm counseled on that deal, too).

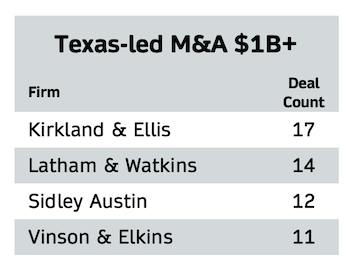

The battle among Texas lawyers to do the mega mergers, acquisitions and joint ventures is fierce. The Texas offices of 22 law firms represented parties in 115 M&A deals that were valued at $1 billion or more in 2021, according to The Texas Lawbook’s Corporate Deal Tracker. Seven different law firms had Texas lawyers advise on 10 or more of those billion-dollar corporate transactions.

The well-documented influx to Texas of folks from other states brings with a whole new set of needs: more schools, more roads, more public facilities of every kind. In 2021, public finance attempted to keep pace with nearly 2,100 issues worth more than $61 billion. Bond attorneys expect a vigorous 2022, but a few caution lights are beginning to flicker. Some are wondering if the raw need for infrastructure improvements can overcome a fickle public appetite for new projects and increasingly intrusive legislative scrutiny. Nushin Huq reports.

Texas lawyers feasted on mergers and acquisitions in 2021. The Texas offices of Kirkland & Ellis did the most deals — though Sidley, Vinson & Elkins and Latham & Watkins were crazy busy. The Texas Lawbook‘s Corporate Deal Tracker lists the law firms that were involved in a record-smashing 929 corporate deals last year and the dealmakers who led those transactions.

Correction:The Texas Lawbook, in an earlier version of this article, undercounted the deal count and deal value for Gibson Dunn, Haynes and Boone and Locke Lord. We apologize for this error.Texas M&A staged a comeback year in 2021 with some astonishing deal numbers. But behind those numbers lies some interesting changes in the business sectors that both gained and changed. Some are obvious, like healthcare and infrastructure; but some are not so obvious, like food. The CDT Roundup looks at some of those numbers and, in particular, one food deal that typifies several ways in which the food sector is changing, along with last week's dealmaking and the firms involved.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.