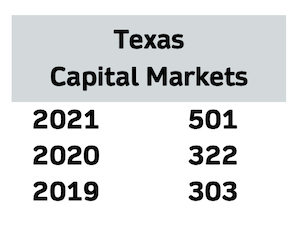

2021 Capital Markets in Texas: An Extraordinary Year ‘Across the Board’

Capital markets deals in Texas were up — way up. The value of those deals were down — way down. But that's not necessarily a bad thing, say our lawyer/dealmakers. Reduced capital budgets, acquisitions made with a clearer sense of purpose and a broader base of issuers created a market in which IPOs made their comeback — and SPACs made their presence felt.